272nd Meeting – July 29-30, 2025

[from the Central Bank of Brazil, 5 August, 2025]

- Update of the economic outlook and the Copom’s scenario1

- The global environment is more adverse and uncertain due to the economic policy and economic outlook in the United States, mainly regarding its trade and fiscal policies and their effects.

- Therefore, the behavior and the volatility of different asset classes have been impacted, altering global financial conditions. This scenario requires particular caution from emerging market economies amid heightened geopolitical tensions.

- Regarding the domestic scenario, the set of indicators on economic activity has shown some moderation in growth, as expected, but the labor market is still showing strength.

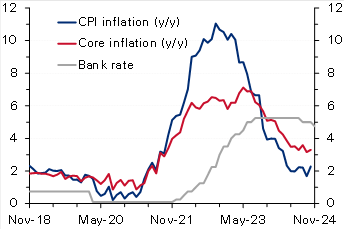

- In recent releases, headline inflation and measures of underlying inflation remained above the inflation target. Inflation expectations for 2025 and 2026 collected by the Focus survey remained above the inflation target and stand at 5.1% and 4.4%, respectively.

- Scenarios and risk analysis

- The inflation outlook remains challenging in several dimensions. Copom assessed the international scenario, economic activity, aggregate demand, inflation expectations, and current inflation. Copom then discussed inflation projections and expectations before deliberating on the current decision and future communication.

- The global environment is more adverse and uncertain. If, on the one hand, the approval of certain trade agreements, along with recent inflation and economic activity data from the U.S., could suggest a reduction in global uncertainty, on the other hand, the U.S. fiscal policy—and, particularly for Brazil, the U.S. trade policy—make the outlook more uncertain and adverse. The increase of trade tariffs by the U.S. to Brazil has significant sectoral impacts and still uncertain aggregate effects that depend on the unfolding of the next steps in the negotiations and the perception of risk inherent to this process. The Committee is closely monitoring the potential impacts on the real economy and financial assets. The prevailing assessment within the Committee is the increased global outlook uncertainty, and, therefore, Copom should maintain a cautious stance. As usual, the Committee will focus on the transmission mechanisms from the external environment to the domestic inflation dynamics and their impact on the outlook.

- The domestic economic activity outlook has indicated a certain moderation in growth, while also presenting mixed data across sectors and indicators.

- Overall, some moderation in growth is observed, supporting the scenario outlined by the Committee. This moderation, necessary for the widening of the output gap and the convergence of inflation to the target, is aligned with a contractionary monetary policy. Monthly sectoral surveys and more timely consumption data support a gradual slowdown in growth.

- At turning points in the economic cycle, it is natural to observe mixed signals from economic indicators—some leading, others lagging—as well as from comparisons between markets, such as the credit and labor markets.

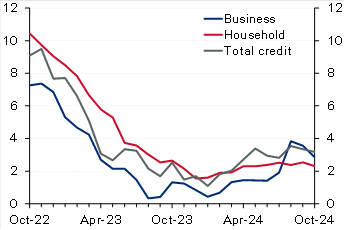

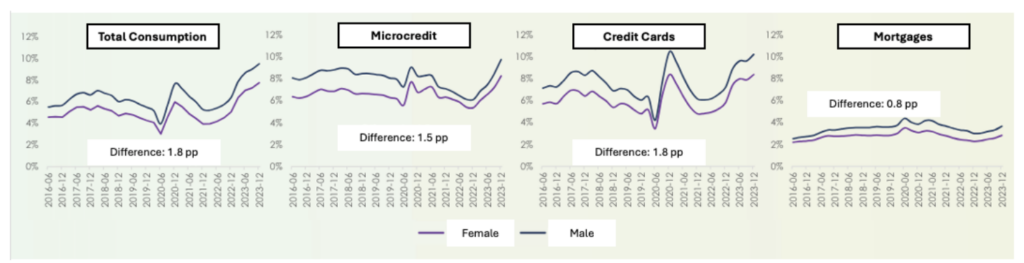

- The credit market, which is more sensitive to financial conditions, has shown clearer moderation. A decline in non-earmarked credit granting and an increase in interest and delinquency rates have been observed. Moreover, regarding household credit, there has been an increase in the household debt–service ratio and a deepening of the negative credit flow—that is, households repaying more debt than taking on. It was emphasized during the discussion that some recent measures, such as private payroll-deducted loans, have had less impact than many market participants expected. Given the implementation agenda in this credit line, as well as the effects of introducing and removing taxes on other credit modalities, the Committee believes it should closely monitor upcoming credit data releases.

- In contrast to the credit market, the labor market remains dynamic. Both from the perspective of income—with real gains consistently above productivity—and employment—with a significant decrease in the unemployment rate to historically low levels—the labor market has greatly supported consumption and income.

- Thus, the Committee assesses that the signals from demand and economic activity so far suggest that the scenario is unfolding as expected and is consistent with the current monetary policy. The Committee reiterates that the aggregate demand slowdown is an essential element of supply–demand rebalancing in the economy and convergence of inflation to the target.

- Fiscal policy has a short-term impact, mainly through stimulating aggregate demand, and a more structural dimension, which has the potential to affect perceptions of debt sustainability and influence the term premium in the yield curve. A fiscal policy that acts counter-cyclically and contributes to reducing the risk premium favors the convergence of inflation to the target. Copom reinforced its view that the slowdown in structural reform efforts and fiscal discipline, the increase in earmarked credit, and uncertainties over the public debt stabilization have the potential to raise the economy’s neutral interest rate, with deleterious impacts on the power of monetary policy and, consequently, on the cost of disinflation in terms of activity. The Committee remained firmly convinced that policies must be predictable, credible, and countercyclical. In particular, the Committee’s discussion once again highlighted the need for harmonious fiscal and monetary policy.

- Inflation expectations, as measured by different instruments and obtained from various groups of agents, remained above the inflation target at all horizons, maintaining the adverse inflation outlook. For shorter-term horizons, following the release of the most recent data, there has been a decline in inflation expectations. For longer-term horizons, conversely, there has been no significant change in inflation expectations between Copom meetings, even though measures of breakeven inflation extracted from financial assets have declined. The Committee reaffirmed and renewed its commitment to re-anchoring expectations and to conducting a monetary policy that supports such a movement.

- De-anchored inflation expectations is a factor of discomfort shared by all Committee members and must be tamed. Copom highlighted that environments with de-anchored expectations increase the disinflation cost in terms of activity. The scenario of inflation convergence to the target becomes more challenging with de-anchored expectations for longer horizons. When discussing this topic, the main conclusion obtained and shared by all members of Copom was that, in an environment of de-anchored expectations—as currently is the case—greater monetary restriction is required for a longer period than would be otherwise appropriate.

- The inflation scenario has continued to show downside surprises in recent periods compared with analysts’ forecasts, but inflation has remained above the target Industrial goods inflation, which has already been showing weaker wholesale price pressures, continued to ease in the more recent period. Food prices also displayed slightly weaker-than-expected dynamics. Finally, services inflation, which has greater inertia, remains above the level required to meet the inflation target, in a context of a positive output gap. Beyond the changes in items, or even short-term oscillations, the core inflation measures have remained above the value consistent with the target achievement for months, corroborating the interpretation that inflation is pressured by demand and requires a contractionary monetary policy for a very prolonged period.

- Copom then addressed the projections. In the reference scenario, the interest rate path is extracted from the Focus survey, and the exchange rate starts at USD/BRL 5.552 and evolves according to the purchasing power parity (PPP). The Committee assumes that oil prices follow approximately the futures market curve for the following six months and then start increasing 2% per year onwards. Moreover, the energy tariff flag is assumed to be “green” in December of the years 2025 and 2026.

- In the reference scenario, four-quarter inflation projections for 2025 and for 2026 are 4.9% and 3.6%, respectively (Table 1). For the relevant horizon for monetary policy—2027 Q1—the inflation projection based on the reference scenario extracted from the Focus survey remained at 3.4%, above the inflation target.

- Regarding the balance of risks, it was assessed that the scenario of greater uncertainty continues to present higher-than-usual upside and downside inflation risks to the inflation outlook. Copom assessed that, among the upside risks for the inflation outlook and inflation expectations, it should be emphasized (i) a more prolonged period of de-anchoring of inflation expectations; (ii) a stronger-than-expected resilience of services inflation due to a more positive output gap; and (iii) a conjunction of internal and external economic policies with a stronger-than-expected inflationary impact, for example, through a persistently more depreciated currency. Among the downside risks, it should be noted (i) a greater-than-projected deceleration of domestic economic activity, impacting the inflation scenario; (ii) a steeper global slowdown stemming from the trade shock and the scenario of heightened uncertainty; and (iii) a reduction in commodity prices with disinflationary effects.

- Prospectively, the Committee will continue monitoring the pace of economic activity, which is a fundamental driver of inflation, particularly services inflation; the exchange rate pass-through to inflation, after a process of increased exchange rate volatility; and inflation expectations, which remain de-anchored and are drivers of future inflation behavior. It was emphasized that inflationary vectors remain adverse, such as the economic activity resilience and labor market pressures, de-anchored inflation expectations, and high inflation projections. This scenario prescribes a significantly contractionary monetary policy for a very prolonged period to ensure the convergence of inflation to the target.

- Discussion of the conduct of monetary policy

- Copom then discussed the conduct of monetary policy, considering the set of projections evaluated, as well as the balance of risks for prospective inflation.

- Following a swift and firm interest rate hike cycle, the Committee anticipates, as its monetary policy strategy, continuity of the interruption of the rate hiking cycle to observe the effects of the cycle already implemented. It was emphasized that, once the appropriate interest rate is determined, it should remain at a significantly contractionary level for a very prolonged period due to de-anchored expectations. The Committee emphasizes that it will remain vigilant, that future monetary policy steps can be adjusted and that it will not hesitate to proceed with the rate hiking cycle if appropriate.

- Monetary policy decision

- The Committee has been closely monitoring with particular attention the announcements regarding the imposition by the U.S. of trade tariffs on Brazil, reinforcing its cautious stance in a scenario of heightened uncertainty. Moreover, it continues to monitor how the developments on the fiscal side impact monetary policy and financial assets. The current scenario continues to be marked by de-anchored inflation expectations, high inflation projections, resilience on economic activity, and labor market pressures. Ensuring the convergence of inflation to the target in an environment with de-anchored expectations requires a significantly contractionary monetary policy for a very prolonged period.

- Copom decided to maintain the Selic rate at 15.00% p.a., and judges that this decision is consistent with the strategy for inflation convergence to a level around its target throughout the relevant horizon for monetary policy. Without compromising its fundamental objective of ensuring price stability, this decision also implies smoothing economic fluctuations and fostering full employment.

- The current scenario, marked by heightened uncertainty, requires a cautious stance in monetary policy. If the expected scenario materializes, the Committee foresees a continuation of the interruption of the rate hiking cycle to examine its yet-to-be-seen cumulative impacts, and then evaluate whether the current interest rate level, assuming it stable for a very prolonged period, will be enough to ensure the convergence of inflation to the target. The Committee emphasizes that it will remain vigilant, that future monetary policy steps can be adjusted and that it will not hesitate to resume the rate hiking cycle if appropriate.

- The following members of the Committee voted for this decision: Gabriel Muricca Galípolo (Governor), Ailton de Aquino Santos, Diogo Abry Guillen, Gilneu Francisco Astolfi Vivan, Izabela Moreira Correa, Nilton José Schneider David, Paulo Picchetti, Renato Dias de Brito Gomes, and Rodrigo Alves Teixeira.

Table 1

Inflation projections in the reference scenario

Year-over-year IPCA change (%)

Footnotes

1 Unless explicitly stated otherwise, this update considers changes since the June Copom meeting (271st meeting).

2 It corresponds to the rounded value of the average exchange rate observed over the ten working days ending on the last day of the week prior to the Copom meeting, according to the procedure adopted since the 258th meeting.

Meeting information

| Date: July 29-30 2025 |

|---|

| Place: BCB Headquarters’ meeting rooms on the 8th floor (7/29 and 7/30 on the morning) and 20th floor (7/30 on the afternoon) – Brasilia – DF – Brazil |

| Starting and ending times: |

| July 29: 10:07 AM – 11:37 AM; 2:17 PM – 5:51 PM |

| July 30: 10:10 AM – 11:13 AM; 2:37PM – 6:34 PM |

In attendance:

| Members of the Copom |

|---|

| Gabriel Muricca Galípolo – Governor |

| Ailton de Aquino Santos |

| Diogo Abry Guillen |

| Gilneu Francisco Astolfi Vivan |

| Izabela Moreira Correa |

| Nilton José Schneider David |

| Paulo Picchetti |

| Renato Dias de Brito Gomes |

| Rodrigo Alves Teixeira |

| Department Heads in charge of technical presentations (attending on July 29 and on the morning of July 30) | |

|---|---|

| André de Oliveira Amante | Open Market Operations Department |

| Euler Pereira Gonçalves de Mello | Research Department (also attending on the afternoon of 7/30) |

| Fábio Martins Trajano de Arruda | Department of Banking Operations and Payments System |

| Luís Guilherme Siciliano Pontes | International Reserves Department |

| Marcelo Antonio Thomaz de Aragão | Department of International Affairs |

| Ricardo Sabbadini | Department of Economics |

| Other participants (attending on July 29 and on the morning of July 30) | |

|---|---|

| Alexandre de Carvalho | Office of Economic Advisor |

| André Maurício Trindade da Rocha | Head of the Financial System Monitoring Department |

| Angelo Jose Mont Alverne Duarte | Head of Office of the Deputy Governor for Licensing and Resolution (attending on the mornings of 7/29 and 7/30) |

| Arnaldo José Giongo Galvão | Press Office Advisor |

| Cristiano de Oliveira Lopes Cozer | General Counsel |

| Edson Broxado de França Teixeira | Head of Office of the Deputy Governor for Supervision |

| Eduardo José Araújo Lima | Head of Office of the Deputy Governor for Economic Policy |

| Fernando Alberto G. Sampaio C. Rocha | Head of the Department of Statistics |

| Isabela Ribeiro Damaso Maia | Head of the Sustainability and International Portfolio Investors Unit (attending on the mornings of 7/29 and 7/30) |

| Julio Cesar Costa Pinto | Head of Office of the Governor |

| Laura Soledad Cutruffo Comparini | Deputy Head of the Department of Economics |

| Leonardo Martins Nogueira | Head of Office of the Deputy Governor for Monetary Policy |

| Marcos Ribeiro de Castro | Deputy Head of the Research Department |

| Mardilson Fernandes Queiroz | Head of the Financial System Regulation Department |

| Olavo Lins Romano Pereira | Deputy Head of the Department of International Affairs |

| Renata Modesto Barreto | Deputy Head of the Department of Banking Operations and Payments System |

| Ricardo da Costa Martinelli | Deputy Head of the International Reserves Department |

| Ricardo Eyer Harris | Head of Office of the Deputy Governor for Regulation |

| Ricardo Franco Moura | Head of the Prudential and Foreign Exchange Regulation Department |

| Rogerio Antonio Lucca | Executive Secretary |

| Simone Miranda Burello | Advisor in the Office of the Deputy Governor for Monetary Policy |

The members of Copom analyzed the recent performance and prospects for the Brazilian and international economies, under the monetary policy framework, whose objective is to comply with the inflation targets established by the National Monetary Council. This document represents Copom’s best effort to provide an English version of its policy meeting minutes. In case of inconsistency, the Portuguese version prevails.