Copom maintains the Selic rate at 15.00% p.a.

[from the Central Bank of Brazil, 30 July, 2025]

The global environment is more adverse and uncertain due to the economic policy and economic outlook in the United States, mainly regarding its trade and fiscal policies and their effects. Therefore, the behavior and the volatility of different asset classes have been impacted, altering global financial conditions. This scenario requires particular caution from emerging market economies amid heightened geopolitical tensions.

Regarding the domestic scenario, the set of indicators on economic activity has shown some moderation in growth, as expected, but the labor market is still showing strength. In recent releases, headline inflation and measures of underlying inflation remained above the inflation target.

Inflation expectations for 2025 and 2026 collected by the Focus survey remained above the inflation target and stand at 5.1% and 4.4%, respectively. Copom’s inflation projections for the first quarter of 2027, currently the relevant horizon for monetary policy, stand at 3.4% in the reference scenario (Table 1).

The risks to the inflation scenarios, both to the upside and to the downside, continue to be higher than usual. Among the upside risks for the inflation outlook and inflation expectations, it should be emphasized (i) a more prolonged period of de-anchoring of inflation expectations; (ii) a stronger-than-expected resilience of services inflation due to a more positive output gap; and (iii) a conjunction of internal and external economic policies with a stronger-than-expected inflationary impact, for example, through a persistently more depreciated currency. Among the downside risks, it should be noted (i) a greater-than-projected deceleration of domestic economic activity, impacting the inflation scenario; (ii) a steeper global slowdown stemming from the trade shock and the scenario of heightened uncertainty; and (iii) a reduction in commodity prices with disinflationary effects.

The Committee has been closely monitoring the announcements on tariffs by the USA to Brazil, which reinforces its cautious stance in a scenario of heightened uncertainty. Moreover, it continues to monitor how the developments on the fiscal side impact monetary policy and financial assets. The current scenario continues to be marked by de-anchored inflation expectations, high inflation projections, resilience on economic activity and labor market pressures. Ensuring the convergence of inflation to the target in an environment with de-anchored expectations requires a significantly contractionary monetary policy for a very prolonged period.

Copom decided to maintain the Selic rate at 15.00% p.a., and judges that this decision is consistent with the strategy for inflation convergence to a level around its target throughout the relevant horizon for monetary policy. Without compromising its fundamental objective of ensuring price stability, this decision also implies smoothing economic fluctuations and fostering full employment.

The current scenario, marked by heightened uncertainty, requires a cautious stance in monetary policy. If the expected scenario materializes, the Committee foresees a continuation of the interruption of the rate hiking cycle to examine its yet-to-be-seen cumulative impacts, and then evaluate whether the current interest rate level, assuming it stable for a very prolonged period, will be enough to ensure the convergence of inflation to the target. The Committee emphasizes that it will remain vigilant, that future monetary policy steps can be adjusted and that it will not hesitate to resume the rate hiking cycle if appropriate.

The following members of the Committee voted for this decision: Gabriel Muricca Galípolo (Governor), Ailton de Aquino Santos, Diogo Abry Guillen, Gilneu Francisco Astolfi Vivan, Izabela Moreira Correa, Nilton José Schneider David, Paulo Picchetti, Renato Dias de Brito Gomes, and Rodrigo Alves Teixeira.

Table 1

Inflation projections in the reference scenario

Year-over-year IPCA change (%)

| Price Index | 2025 | 2026 | 1st quarter 2027 |

|---|---|---|---|

| IPCA | 4.9 | 3.6 | 3.4 |

| IPCA market prices | 5.1 | 3.5 | 3.3 |

| IPCA administered prices | 4.4 | 4.0 | 3.9 |

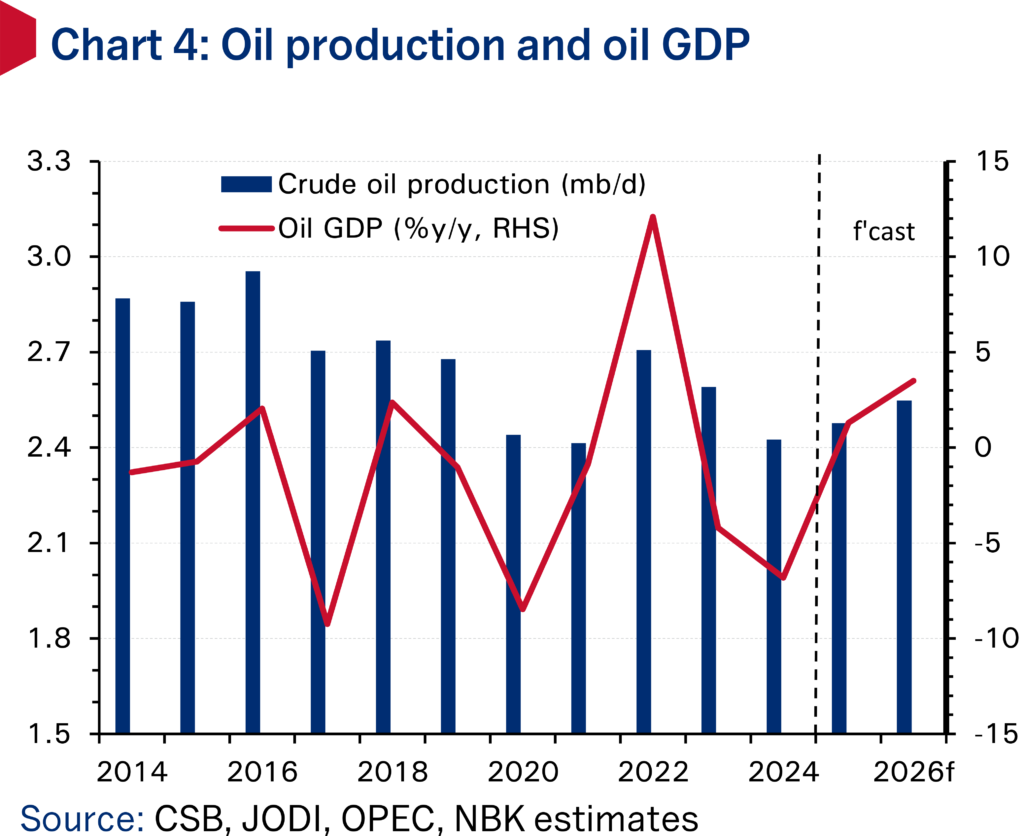

In the reference scenario, the interest rate path is extracted from the Focus survey, and the exchange rate starts at USD/BRL 5.55 and evolves according to the purchasing power parity (PPP). The Committee assumes that oil prices follow approximately the futures market curve for the following six months and then start increasing 2% per year onwards. Moreover, the energy tariff flag is assumed to be “green” in December of the years 2025 and 2026. The value for the exchange rate was obtained according to the usual procedure.

Note: This press release represents the Copom’s best effort to provide an English version of its policy statement. In case of any inconsistency, the original version in Portuguese prevails.