[from the Federal Reserve Bank of Richmond, 8 August, 2025]

by R. Andrew Bauer, Renee Haltom and Matthew Martin

Regional Matters

Ever since new tariffs were enacted in early 2025, a key policy question has been what is the extent to which businesses will pass tariff costs through to prices, and when? The effects of a tariff are rarely straightforward, given, among other things, competitive dynamics and the challenges of implementation, but the historically large and changing nature of these tariffs have created additional levels of uncertainty over the effects.

In uncertain times, anecdotal evidence from businesses can be especially insightful. We are learning how businesses are reacting to tariffs through the Richmond Fed’s business surveys as well as through hundreds of one-on-one conversations with Fifth District businesses since the start of 2025.

These conversations showcase that navigating tariffs is a complex and sometimes protracted process for firms, particularly when there is uncertainty. Firms describe several reasons they may not have experienced the full impact of proposed tariffs yet (even when goods and countries they deal with are subject to them), as well as reasons that even when they have incurred tariff-related cost increases, there can be a delayed impact on pricing decisions.

Reasons Firms May Not Have Incurred Tariffs Yet

Business contacts describe several strategies or circumstances that can delay or reduce the tariffs on inputs or other imported items. These include the following:

- Delayed ordering. In response to announced tariffs, many firms ran down existing inventories or ran inventories lean in hopes that tariffs would become lower. For example, a national retailer said everyone was “delaying all we can delay in hopes we get more clarity on trade deals” and reported meeting with procurement teams multiple times per week to discuss ports and ship capacity, evolving tariffs, and inventories to keep goods flowing and prices as low as possible. One port said they have a crane waiting to be shipped but can’t do so now due to the tariff cost.

- Delaying the tariff charge. Firms report using short-term tactics that allow a good to be shipped but delay the point at which the tariff is incurred. Bonded warehouses have become one well-known example. One national retailer noted a two-week “grace period” with importers, and a steel wholesaler/distributer reported having orders on hold in Canada waiting to be shipped from their supplier. Some firms also report stockpiling inventory in lower-tariff countries, which has to be weighed against the cost of adding a shipping stop.

- Cost-sharing. Vendor relationships are often long term, and many firms report partnering with suppliers and customers to share costs. When tariffs first rolled out, multiple firms (a beverage distributer, supply chain logistics company) anticipated a “rule of thirds” where the cost was split evenly among the supplier, the importer, and the customer. A national retailer reported being large enough to force suppliers to bear much of the cost, though it varied by relationship and item. Interestingly, firms also reported that cost-sharing is not necessarily a permanent solution: A steel distributer said that with the second round of tariffs announced in June, “The ‘kumbaya’ of cost-sharing was likely to come to an end.” Similarly, a fabric manufacturer said that upon an announced trade deal with Vietnam that took tariffs from 10 percent to 20 percent, suppliers took a new stand on cost sharing: “Most vendors said you’re on your own” for the second 10 percent, and one even clawed back cost-sharing from the first round.

- Transit time. It takes up to six weeks for container ships to arrive to the East Coast from China, so even if firms are ordering goods, there is a natural delay when the tariff is incurred. Shipping time in a world of rapidly changing tariff proposals add to uncertainty around tariff costs.

- Tariff implementation delays. Richmond Fed economist Marina Azzimonti has found that a variety of tariff implementation delays help explain why actual tariffs as of May 2025 were much lower than expected. These factors include legacy exemptions and delays in customs system updates. Azzimonti also finds that a small percentage is explained by countries substituting away from high-tariff countries. For example, one national retailer we spoke with was in the process of dropping 10 percent of products sourced from China. Whether a company can change sourcing varies dramatically by type of firm and product.

As our monthly business surveys have found, many firms report deploying more than one strategy to delay tariffs. Notably, many of these delays are only temporary.

Reasons Tariffs May Have a Delayed Impact on Prices

Even when firms have incurred tariffs, they give several reasons why tariffs may not be immediately reflected in the prices they charge for their products. These include the following:

- Waiting for tariff policy to clarify. Higher prices could reduce demand for goods and services and/or lead firms to lose market share, so many firms said they are hesitant to increase prices until they’re sure tariffs will remain in place. For example, a large national retailer said if tariffs are finalized at a sufficiently low level, they’ll absorb what they’ve incurred to date, but if high tariffs stick, they’ll have to raise prices. A steel fabricator for industrial equipment described being reluctant to raise prices on the 10 percent cost increases they’d seen thus far but would have to raise prices should the increases reach 12 to 13 percent. A grocery store chain was reluctant to raise prices and instead might reduce margins, which had recovered in recent years, to maintain their customer base. Some firms explicitly noted a strategy to both raise prices over time and pursue efficiency gains to cut costs and completely restore margins within a year or two.

- Elasticity testing. Firms reported testing across goods whether consumers will accept price increases. A furniture manufacturer said he’s seen competitors pass along just 5 percentage points of the tariffs at a time so it isn’t such a huge shock to customers, though in that sector, “We all end in the same place which is the customer bearing most of it.” A national retailer said most firms are doing a version of stair-stepping tariffs through, e.g., raising prices a small amount once or twice to see if consumer demand holds, and if so, trying again two months later. This retailer said prices were going up very marginally in early summer, would increase more in July and August, and would be up by 3 to 5 percent by the end of Q4 and into 2026. Another national retailer said they would start testing the extent to which demand falls with price increases, e.g., when the first items that were subject to tariffs—in this case back to school items—hit shelves in late July.

- Blind margin. Some firms reported attempting to pass through cost in less noticeable ways. While any price increase to consumers will be captured in measures of aggregate inflation, the fact that price increases may occur on non-tariffed goods might make it difficult to directly relate price increases to tariffs. An outdoor goods retailer said, “Unless it’s a branded item where everyone knows the price, if something goes for $18, it can also go for $19.” A national retailer plans to print new shelf labels with updated pricing, which will be less noticeable for consumers compared to multiple new price stickers layered on top. This takes time (akin to a textbook “menu cost” in economics), so it will not be reflected in prices until July and August. A grocery store said their goal was to increase average prices across the store but focus on less visible prices.

- Selling out of preexisting inventory: Many firms noted they still have production inventory from before tariffs were announced, so they do not need to raise prices as long as they still sell these lower cost goods. A national retailer noted they have at least 25 weeks of inventory on hand for most imported products. A firm that produces grocery items said they will decide how much to raise prices as they get closer to selling tariff-affected products. Similarly, retailers order seasonal items quarters in advance. Many were receiving items for fall and winter when the new tariffs were going into effect in the spring. They paid the tariff then, but we won’t see the price increase until those items hit the shelves in the fall or winter. One retailer speculated that seasonal décor items will look the most like a one-time increase.

- Pre-established prices. Many firms face infrequent pricing due to factors like annual contracts or pre-sales. For example, a dealer of farm equipment gets half its sales through incentivized pre-sales to lock in demand and smooth around crop cycles. They noted that while it would be difficult to retroactively ask those customers to pay for part of the tariff, they will pass tariffs directly through on spare parts. A steel fabricator for industrial equipment has a contract for steel through Q3, so they haven’t been impacted yet by price increases. However, they will face new costs once that contract expires.

In general, compared to small firms, large firms have more ability to negotiate with vendors, temporarily absorb costs, burn cash, wait for strategic opportunity, and test things out. This matters because large firms often lead pricing behavior among firms, so these strategic choices may influence the response of inflation to tariffs more generally. Even within firm size, one often hears that negotiations on price vary considerably by relationship and item.

Conclusion

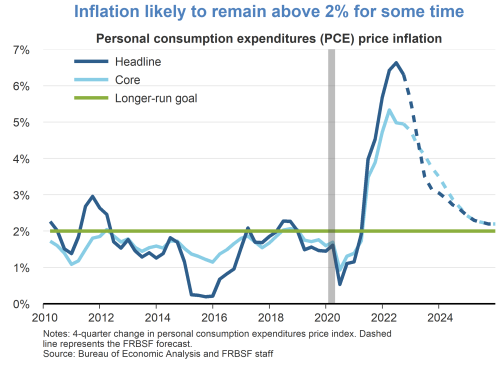

A key question surrounding tariffs is whether any effects on inflation will resemble a short-lived price increase—as in the simplest textbook model of tariffs—or a more sustained increase to inflation that may warrant tighter Fed monetary policy. When asked in May what will determine the answer, Fed Chair Jerome Powell cited three factors [archived PDF]: 1) the size of the tariff effects; 2) how long it takes to work their way through to prices; and 3) whether inflation expectations remain anchored. The insights shared above suggest the process from proposed tariffs to the prices set by firms is far from instantaneous or clear-cut, particularly when tariff policy is changing.

Sensing from businesses suggests that the impact of tariffs on their price-setting [archived PDF] has been lagged, but it is starting to play out. Nonetheless, it remains highly uncertain how tariffs will impact consumer inflation. The discussion above makes clear that firms are nimble and innovative in the face of challenge, and they are concerned about losing customers in the current environment, particularly consumer-facing firms. We will continue to learn from our business contacts and share their insights.

Views expressed are those of the author(s) and do not necessarily reflect those of the Federal Reserve Bank of Richmond or the Federal Reserve System.